There is a sense of tectonic shift in the marketing technology space. Of course, it's a space that has grown and evolved at an incredible rate for about ten years. I'm talking about more fundamental change.

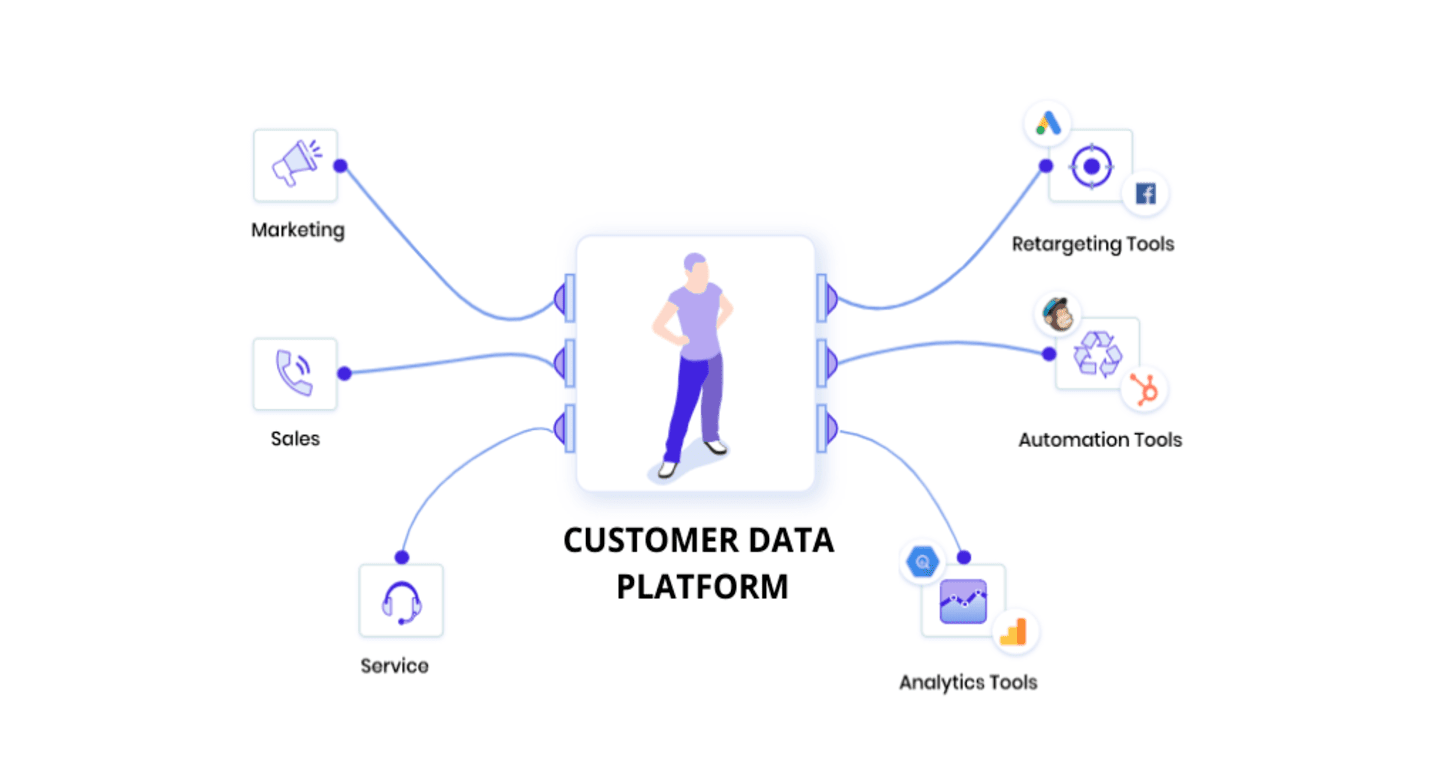

Think of marketing automation, CRM, and customer data as three of the building blocks that make up the marketing technology envelope. They are moving. Perhaps incredible at the level of day-to-day operations and campaigns, but clearly at a more strategic level. Honestly, I don't know what the new configuration of marketing technology will look like – but I think I know the right question to ask: What is the future of customer data platforms? Will a CDP take on the enablement and execution role of marketing automation? Will they replace CRM as the customer data repository?

Boom or bust for independent CDPs?

It's easy – and accurate – to think of the CDP category as large and growing. There is a lot of interest in CDPs, especially, but not only, from enterprise B2C brands trying to personalize their customer interactions at scale. At the same time, independent CDPs, some of which are already established and well-known, are being consumed by more comprehensive marketing suites or digital experience platforms at an unprecedented rate.

AgilOne acquired by Acquia, Segment by Twilio, Zylotech by Terminus, Boxever by Sitecore, Zaius by Optimizely, BlueVenn by Upland Software, Exponea by Bloomreach: It's a trend. At the same time, independent CDPs like Treasure Data, Amperity, Tealium and Blueshift have raised significant amounts of money this year.

The need for independent CDPs

I turned to one of the closest observers of this category, David Raab, founder of the CDP Institute and an occasional MarTech contributor. “In most cases, the companies that buy them have multi-channel distribution systems. Those systems were often acquired and not natively integrated, and they realized they needed a CDP to pull together data to integrate their own systems, as well as pull data from other channels that they don't manage. Their buyers have a need for consolidated data. It's really difficult to build a CDP so it makes more sense to buy one. Easier and faster. ”

Does this trend threaten the independent CDP category? “It definitely narrows the market for independents,” he said. “What we expect to happen is that independents will specialize more in specific niches, making it easier for them to defend their positions.”

There will continue to be a need for independent CDPs at the enterprise level, where multiple functions – not just marketing – are needed to be able to manage and activate customer data. “That's where ActionIQ sits, that's where Treasure Data sits,” Raab said. “You need that CDP to be vendor neutral. Then there will be verticals, specializing in transportation, health or education. We're seeing a lot of CDPs who are experts in the vertical, and that's also a defensible position. ”

In fact, ActionIQ recently announced itself as the CDP for the healthcare space, while Treasure Data, which started out selling to marketing organizations, is now explicitly addressing other functions within the enterprise. with CDP for Services and CDP for Sales.

Next generation campaign management

It is actually received wisdom that not every solution offered as a CDP is a true CDP, but in reality, it is probably accurate to say that there are always different types of CDPs. The distinction is becoming clearer as some CDPs aim to not only be the single source of truth about the customer, but also the hub for orchestrating and delivering the customer experience.

This type of full-service CDP goes by many different names. Vijay Chittoor, founder and CEO of Blueshift, calls CDPs that unify profiles, segment audiences, and activate campaigns “intelligence hub” CDPs, a term borrowed from Gartner. Argyros talks about CDPs as “CX hubs” or “next generation campaign management.”

Argyros argues that customer intelligence is also important. The tools to implement customer intelligence outside of a CDP are inherently limited. Website analytics is limited to website activity. Business intelligence provides good aggregate level data but cannot provide detailed information on the customer journey level. “The CDP has actually become a place to gather intelligence and tie it really well to operations. You go from data to intelligence to action in the same platform, which is CDP. ”

Do smart hub CDPs make marketing automation redundant?

Raab does not see CDPs usurping MA's throne. “Most marketing automation systems actually primarily send email, and there are some CDPs that can send email.” He offers Algonomy as an example of a CDP with core email marketing capabilities.

“There are quite a few people who have very strong distribution capabilities, channel-oriented capabilities, and they are doing absolutely what marketing automation can do,” he said. “In other cases, not so much. Marketing automation often has a B2B flavor and has tight integration with CRM systems. You have a bunch of specialized features that you're getting from the marketing automation system that may not be integrated into the CDP. ”

There are also key differences in how data is structured in marketing automation and CDPs, he added. “You have a large batch data warehouse that stores everything in every great detail – semi-structured at best.” That's CDP. “Then you have a more structured data store, do all your segmentation and run your marketing automation, etc. Basically, you will always have two other types of technology each other, each doing what they do best. Are they in the same system? Great, that saves you some trouble. ”

Original post: https://martech.org/deep-changes-in-the-cdp-space/

Translated by: Phan Cong Duy