Salestech is a hot topic right now.

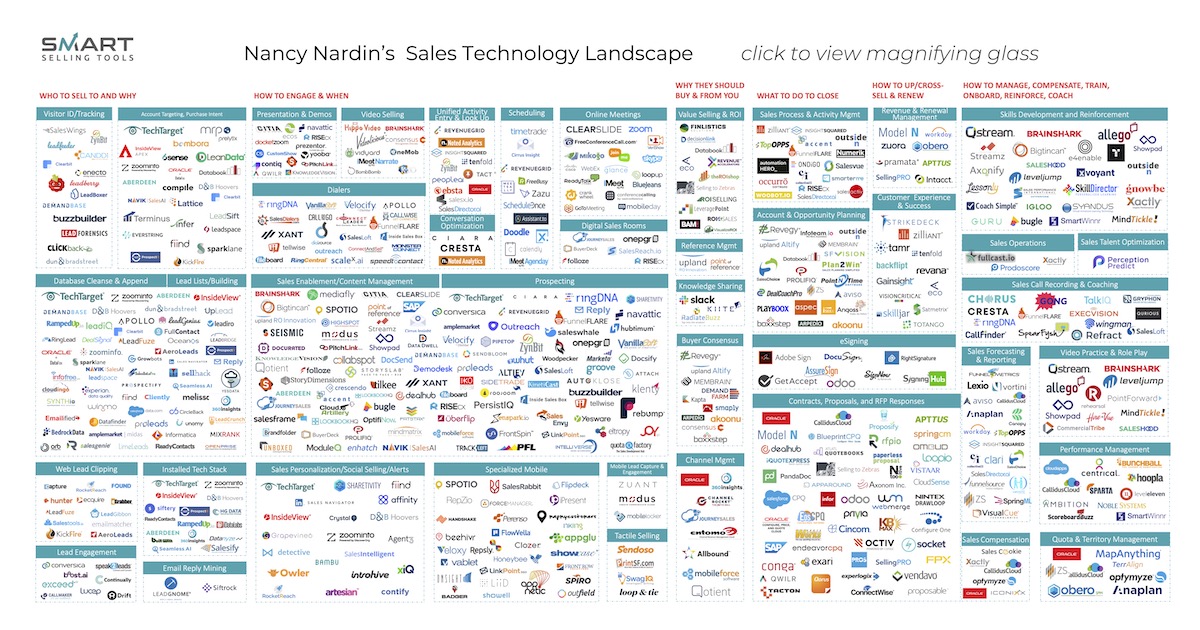

Nancy Nardin is from Smart Selling Tools has been following Salestech the same way I’ve been following Martech. Her latest report shows there are hundreds of tool vendors in the market, categorized into a few dozen categories.

And as far as I know about Martech, the field is not even complete. I personally know dozens of companies that provide Salestech tools that are not listed. And many more are being developed every month.

In Hubspot's App Marketplace – Disclosure:Where I work – we have seen a lot of sales apps and integrations introduced in just the last 12 months.

The reason behind the explosion of SaaS-based sales tools is similar to Martech: unifying platforms and expanding the ecosystem of applications around them. Examples of dedicated platform-based sales technology applications include Troops, which connects messaging platforms like Slack and Teams with CRM platforms like HubSpot, Salesforce, and Docket, which deeply integrates Zoom, CRMs, Slack, calendars, and digital storage to unify meetings.

Many of the top commerce tech companies are reaching multibillion-dollar valuations. Recent unicorns include Outreach, which reached a $1.33 billion valuation last summer, and SalesLoft, which reached a $1.1 billion valuation just last week.

Naturally, where there is such a large supply, there will be a large demand.

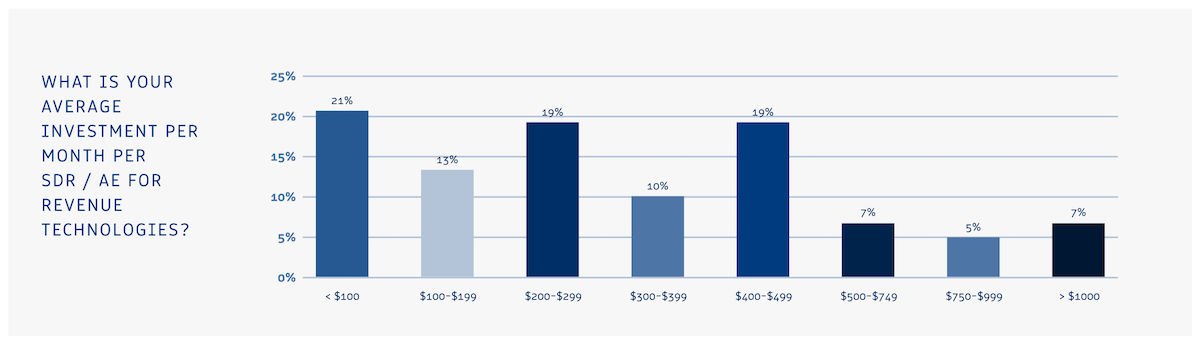

Data from Recent report benchmarks revenue performance and customer acquisition in 2021 by ringDNA and RevOps Squared The study found that 38% companies surveyed are spending $400 or more per response (SDR or AE) per month:

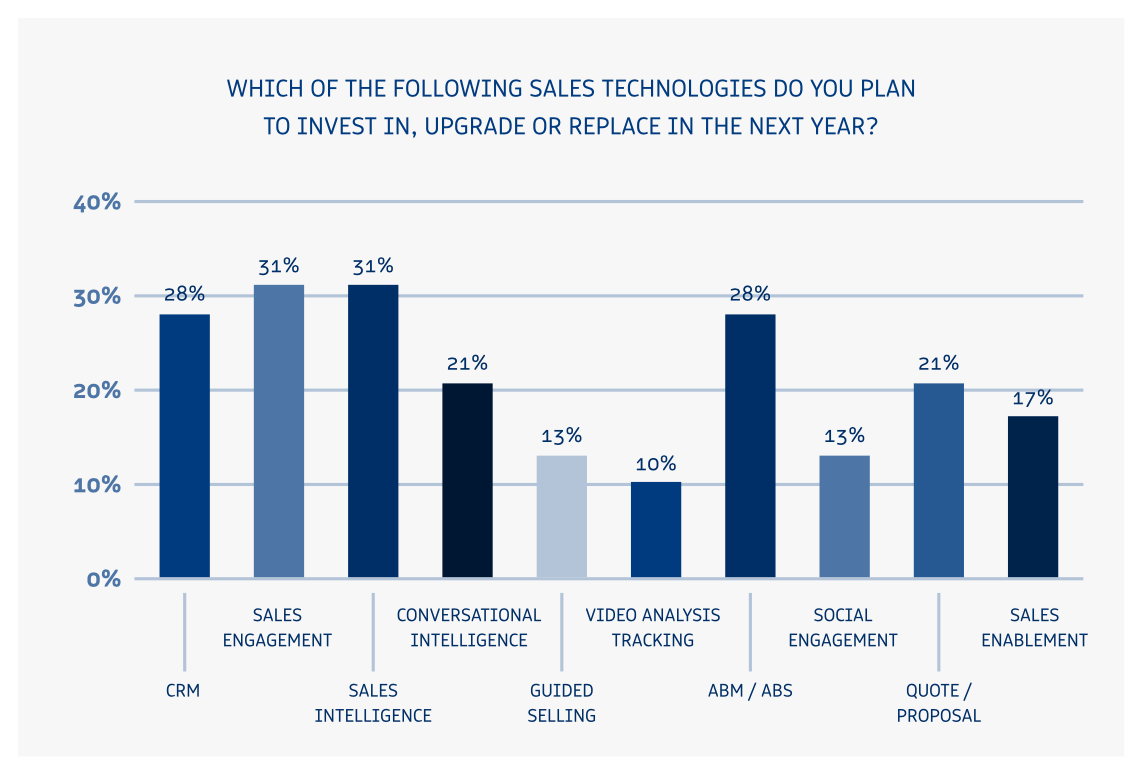

That's a pretty big investment. And signs are that investment will increase in 2021, as companies have secured a slew of innovative tech commercial products:

Salestech has been evolving over the past few years. But like other digital functions, the circumstances of 2020 have accelerated the adoption of these technologies to leverage retail distributors, remote selling, and expand customer reach on social media platforms.

However, it is still early days for us to penetrate potential markets. Many leading e-commerce technology companies have only the basic platforms today. They are ready to grow exponentially to tens of thousands and hundreds of thousands of customers in the coming years.

Aragon Research predicts the market sales engagement will be $5.59 billion by 2023. Data Bridge Market Research estimates the market sales intelligence will be $4.89 billion by 2027. And 360 Research Reports predicts the market sales potential will be $3.08 billion by 2026.

Most of those predictions were calculated before the digital acceleration in 2020. I think we'll see much bigger numbers soon.

For Martech, the advancement of Salestech is a great thing.

First and foremost, all of these digital commerce touchpoints will contribute a wealth of data to a company’s overall operating platform. This will provide more specifics about which strategies work best for which customer segments, extending the customer journey. In turn, this will make it easier to leverage that data to shape personalized marketing and sales efforts for those audiences. This will allow marketing teams to be more targeted in their approach.

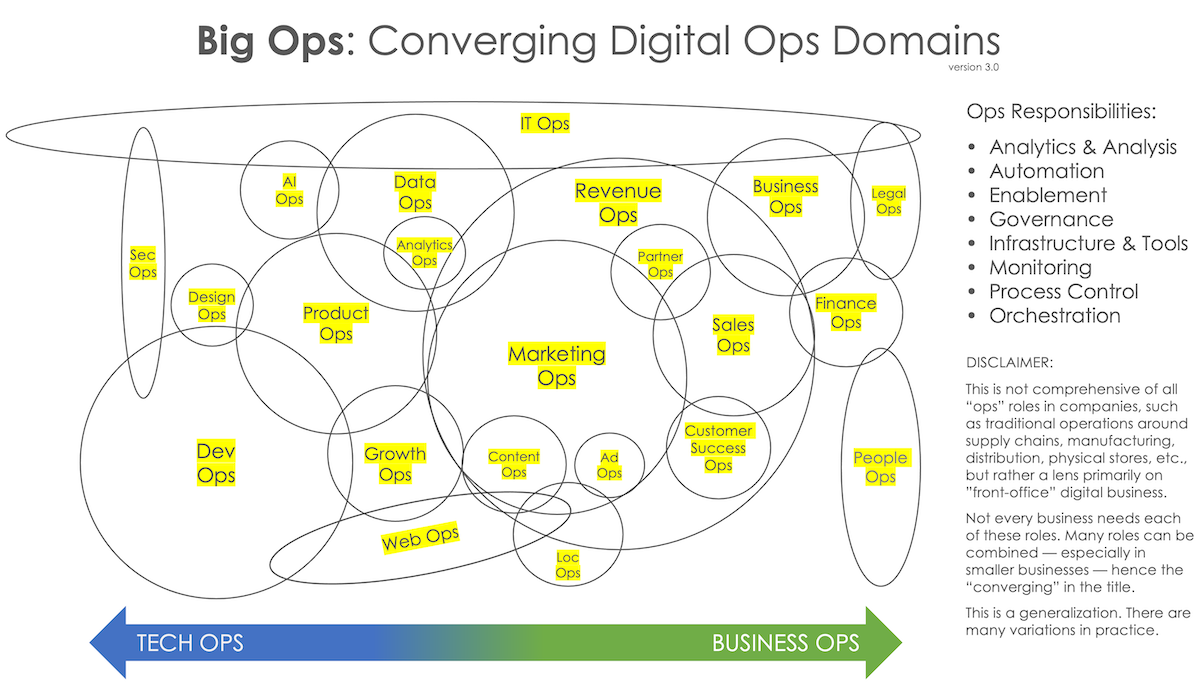

The growing digital literacy of sales teams – and sales operations leaders – will also create greater alignment and collaboration between Marketing and Sales as a whole. More integration between Marketing and Sales will occur through Martech and Salestech tools, which will facilitate the integration of the operations and processes these teams operate together.

This collaborative integration between Marketing and Sales is what’s driving the rise of “revenue operations.” And that integration is just one part of the overall movement toward Big Ops that I believe will be one of the most important. Five trends of the technology market in the next decade.

Original post: https://chiefmartec.com/2021/01/salestech-new-martech-supercharging-professions/

Translator: Hoang Bach